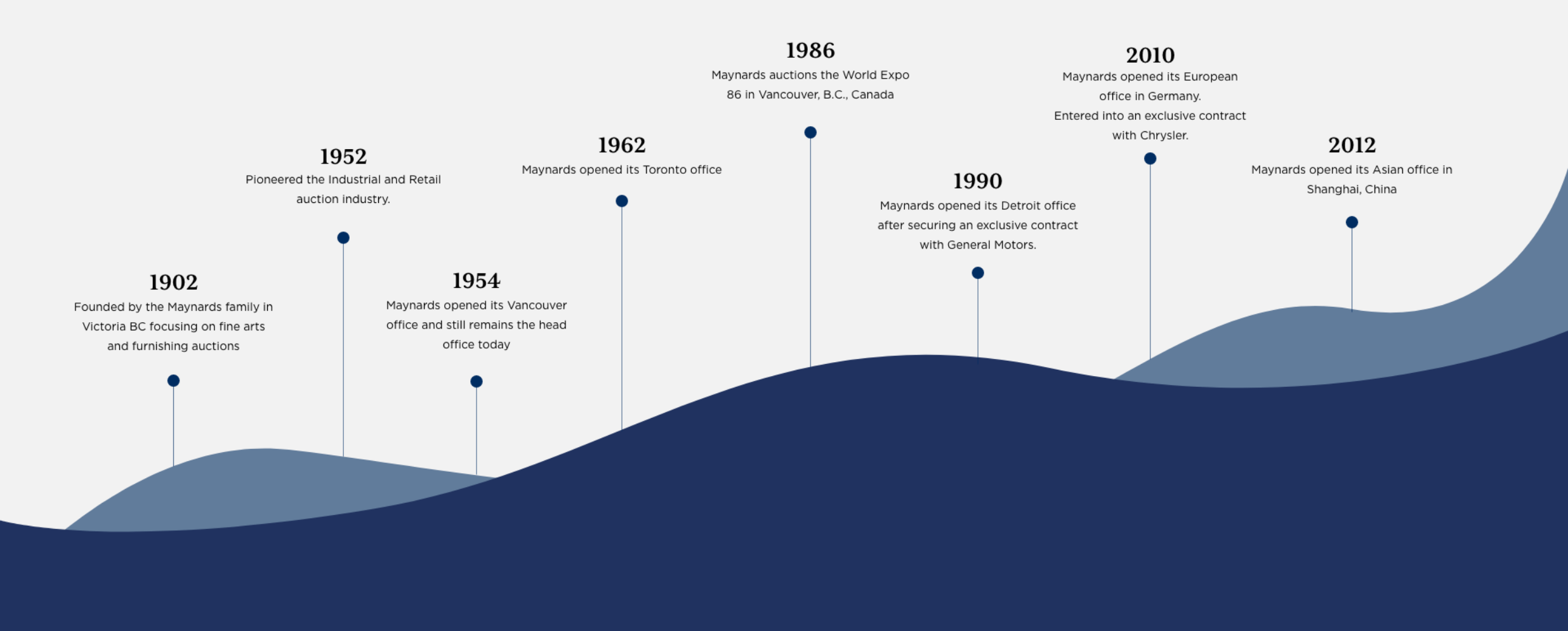

Maynards expertise in the machinery and equipment industry spans over a century.

From early beginnings, as a single store front auction house, to our current global footprint, Maynards has continuously enhanced our liquidating, appraising, and financing expertise for the benefit of our customers. Whether a single asset valuation, or a multilocation liquidation, Maynards is committed to providing our customers’ with insights and options to help inform their procurement, divesture, and capitalization of machinery and equipment decisions.

Maynards’ recipe for success in the used machinery and equipment industry is a combination of experience, integrity, research, relationships, and initiative. Maynards leverages more than a century of developing these important ingredients which has enabled us to consistently deliver the highest returns and value to our customers.

We do this by combining traditional sales methods with innovative marketing strategies, contrasting the prevailing forces of supply and demand with our database of historical comparables, and offering customizable financing structures to meet the needs of our customers.

Maynards at a Glance

We work with our customers equity in their used machinery and equipment and we deploy funds quickly. Our customers often use funds to support working capital, refinance existing debts, acquire shares, and or acquire additional equipment.

Why Maynards? We are able to pinpoint and recognize actual collateral values cs. Book values. This expertise often translates to more aggressive financing terms than many other lenders in the marketplace can offer.

As a world leader in asset disposition services, we use our first-hand knowledge of auction results, our unmatched proprietary database, and decades of on-site expertise to provide recovery values across all value-definition scenarios.

Our certified team of appraisers complete hundreds of reports annually un dozens of industry segments, providing our clients with real-world obtainable value conclusions, often critical in helping companies obtain working capital.

We perform asset sales and valuations across the industrial spectrum from offices in Vancouver, Toronto, Detroit, Munich, and Shanghai. Over the past decade, we have grossed over $800 million in auction sales across more than 1,000 auctions.

Michael Ostrom,

ASA, CEA, ARM-MTS

Director of Valuation Services

Western Region

(714) 351-8615

Email Michael

Michael brings over 20 years of experience to Maynards Industries.

His knowledge comes from years in the machinery and equipment valuations, auctions and liquidation during his career with DoveBid Valuations Services, Greystone & Co., Lakonia Machinery Appraisals, and the Maynards Group.

Aaron Stewardson

COO

Maynards Group

(604) 787-0749

Email Aaron

Aaron is a Chartered Accountant and joined Maynards Industries in 2009. He previously worked for EY in the Transaction Advisory Services group in both Canada and the US, predominantly working in the Restructuring Group on files such as Air Canada, and Skeena Cellulose.

During his time, he also worked closely with numerous private equity groups in funding transactions on both sides of the border.

Aaron is active in the community being a director of Easters Seals and serving on a committee with BC Children’s hospital. He is an SVP for Maynards Capital as well.

Matthew Suzuki

Director,

Portfolio Management

(480) 527-6654

Email Matthew

Matthew has worked on and off with Maynards since he was 8! The auction and liquidation business is in his blood.

Matthew re-joined the Maynards Group under the Maynards Capital umbrella back in 2020.

Matthew brings years of banking experience and exposure to complex credits structure to assist in managing and growing the Maynards Capital portfolio.